Beta Yourself: Money

Disposable income disappearing quicker than it should? We've got some tips for you

Has your wallet still got a thunderous hangover from the New Year?

Well lucky for you, financial expert Tara Evans shares cures for evaporating cash and stock market tips for budding investors.

Whether you’re saving up for a well-deserved trip away, that new VW Golf GTE, or you just fancy a small taste of the high-life – this is the guide that’ll help you get there.

The basics

Save a grand in a day.

Companies make a tidy profit from your procrastination and inertia. Put a day aside to shop around for better household and personal bills. For a four-step ‘Money Makeover’ plan, go here.

Get a free check-up.

Your credit score can affect the offers you get on everything from mortgages to smartphone contracts. Get a free check from the big three agencies (Experian, Equifax and Callcredit) by signing up for a free trial then cancelling within 30 days.

Boost your score.

To improve your credit score, make sure you’re on the electoral register, set up direct debits to ensure you never miss a payment and cancel any unused cards. There is no single score, so lenders might rate you differently.

Find your perfect match.

Get bank account comparisons by downloading the Midata file from your online banking service. Find the ‘search with Midata’ button on gocompare.com, upload your file, and you’ll get personalised recommendations.

Divide and conquer.

Apple Pay might not offer P2P payments yet, but Pingit (£free / iOS, Android) is an easy way to split bills in the meantime. It lets you send payments to anyone using their mobile number.

Start a mini Kickstarter.

Need to collect money for your birthday bash or restaurant bill? Tilt (£free / iOS, Android) lets you create a campaign for friends to chip into. It’ll even do the awkward nagging for you.

Savings sidekicks

Take the long view.

You Need A Budget (£free / iOS, Android) lets you manage your money in one handy place.

Learn to save.

Nationwide’s app (£free / iOS, Android) has a handy ‘Impulse Saver’ feature that lets you transfer pre-agreed amounts to savings without logging in.

Take a train to Savingsville.

If you travel by train in London and can’t afford an annual Travelcard, CommuterClub could save you cash by offering better rates than TfL.

Fab phablet coming soon › Samsung learns its lesson, plans to launch Galaxy Note 6 in the UK

Spend zone

Get the big picture.

Use a budget planning service like OnTrees or YourWealth to link all your accounts in one place. They’re good for seeing which splurges need reining in.

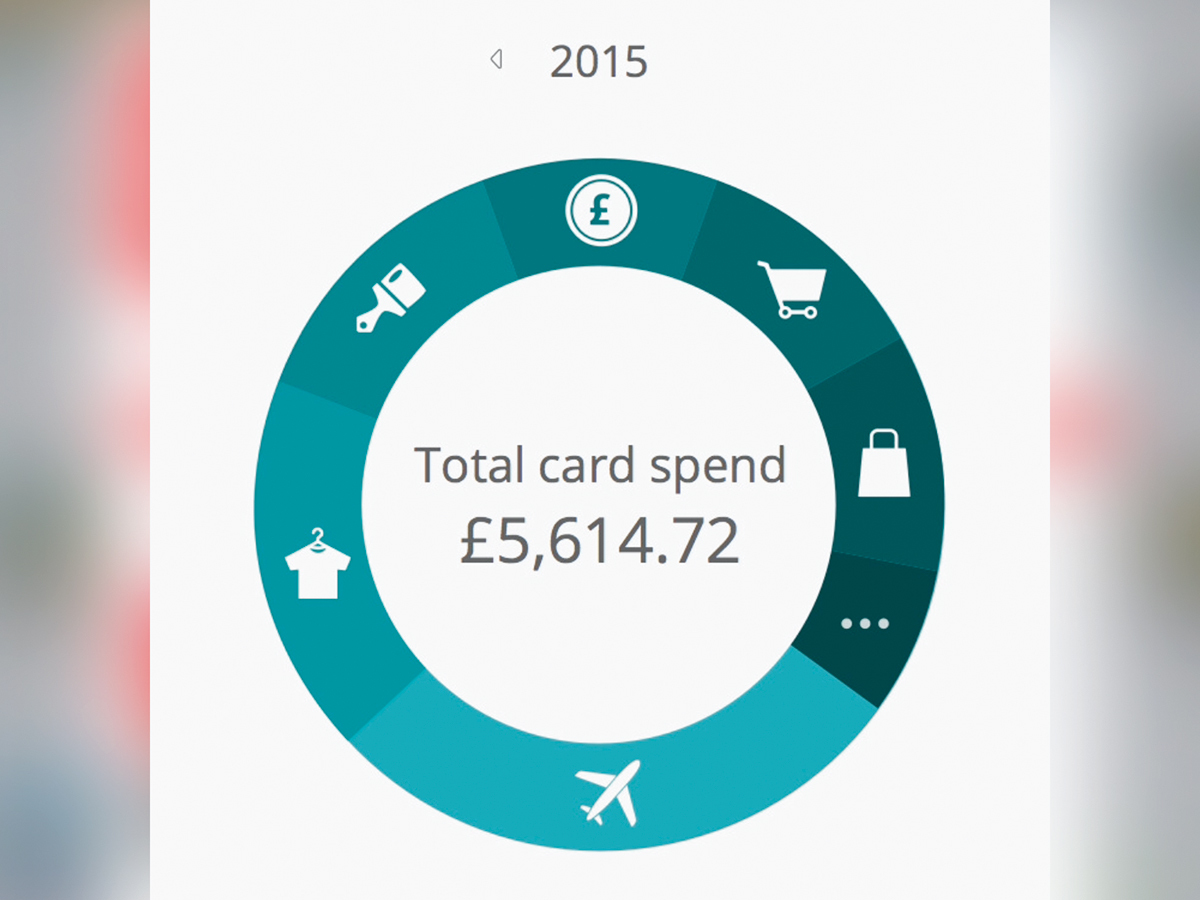

Graph it up.

If you bank with Santander, take advantage of its Spendlytics app (£free / iOS), which serves up some lovely charts of your spending.

Earn a warm glow.

Give to your chosen charity when you shop with giveasyoulive.com – it works like a cashback site, donating the retailer’s kickback

Sound investments

Pick the right platform.

Nutmeg and rplan make investing easy. There are two models: one with an admin charge, one taking a percentage of your holdings.

Outsource the research.

Stockomendation (from £free) collates web tips, and lets you set up alerts for stocks and shares.

Level up your shares.

Sharepad (£250/year) is aimed at those wanting to take control of an ISA or SIPP pension.

Stream like a dream › The best TV streaming boxes and sticks – reviewed

P2P Lending

What is it?

Sites like Funding Circle, Zopa and RateSetter let people lend to and borrow from each other, offering a return of up to 7%.

It’s not a golden ticket.

If one of the people you lend to defaults, your average return will fall. P2P lenders stress that their rate of bad debts is lower than the banks’ because of strict lending criteria.

Don’t forget the taxman.

Any interest you earn is subject to income tax in exactly the same way as normal savings.

Level up with…

The book – Money Made Easy 2015-16

Written by Laura Whitcombe and Mark King, previously of mag Moneywise, this is a good financial reference point for pretty much every stage of your life. From how to get a pay rise, to buying and selling property, to organising your savings for big life events like marriage or children, it’s the thing to reach for when financial hardship reaches ‘card declined’ levels. £10.50 / amazon.co.uk

The podcast – Money Box

Yep, it’s been going almost as long as money itself, but this is still the best financial show. Every week there are exclusive investigations mashed up with an overview of the latest money news from journalist Paul Lewis and his team. Download or listen live while you make dollar sandwiches every Saturday from 12 noon. £free / iTunes

The blog – Jordon Cox aka the Coupon Kid

For the past three years, the Coupon Kid has dedicated his spare time to saving money and using coupons. Just 18, he’s now blogging for Martin Lewis’s MoneySavingExpert site. He says being called weird or crazy for his extreme money saving is just “water off a couponer’s back”. Which is good news, because we can all learn a little from Jordon and friends’ frugality. moneysavingexpert.com

App store superstars › App Watch: the best new iOS games released this month